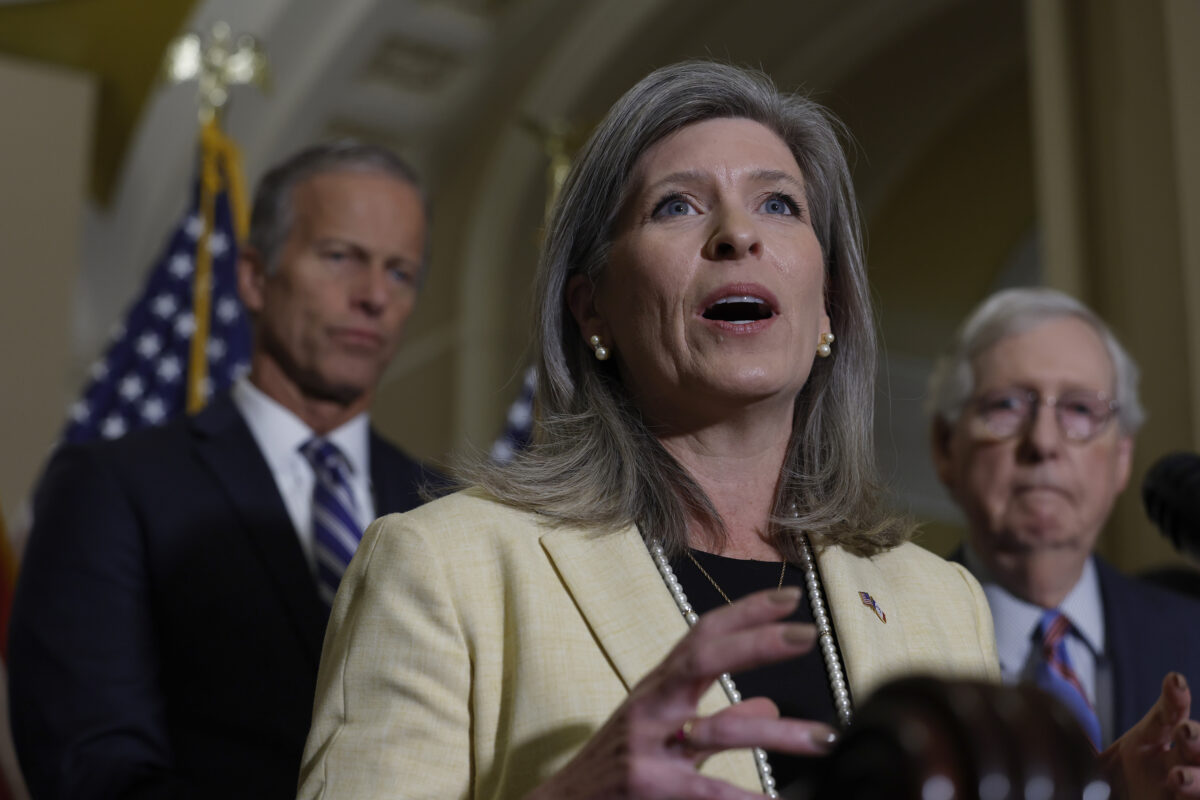

Sen. Joni Ernst (R-Iowa) announced a bill Tuesday that would bar the Internal Revenue Service (IRS) from providing arms and ammunition to agents with taxpayer money.

The measure would prohibit the federal tax agency from purchasing, receiving, or storing guns and ammunition, according to Ernst’s office. Under the bill, ammunition and firearms that are currently in possession by the IRS would be transferred to another federal agency, the General Services Administration, for auction.

“The taxman is fully loaded at the expense of the taxpayer,” Ernst said in a news release, adding that after the IRS has been expanded in recent years, “any further weaponization of this federal agency against hardworking Americans and small businesses is a grave concern.”

She added, “I’m working to disarm the IRS and return these dollars to address reckless spending in Washington.”

The measure would also relocate the armed wing of the IRS, the agency’s Criminal Investigation Division, within the Department of Justice.

Ernst’s office cited OpenTheBooks, which found that the agency spent millions of taxpayer dollars on AR-15-style rifles, semi-automatic shotguns, “submachine guns,” and stockpiled some 5 million rounds of ammunition.

“The IRS special agent is starting to look less like a desk worker or rule maker and more like a SWAT team from a Hollywood thriller. It’s the blurring of the lines between a tax agency and traditional law enforcement,” Adam Andrzejewski, the CEO of OpenTheBooks, said in the release.

Last year, there was backlash against the IRS after it posted job descriptions for a special agent position that would require the agent to potentially use “deadly force,” according to a Substack post by Andrzejewski.

“Regular Americans have a right to be concerned when the IRS is armed to the teeth and the lines between general administrative agencies and criminal law enforcement agencies are blurred,” he wrote. “For example, earlier this year, Matt Taibbi, a journalist on the Twitter Files, received a visit from an IRS agent at home the same day of his Congressional testimony.”

His organization noted that the phenomenon is not new. The IRS has spent some $35.2 million on ammunition, guns, and other military-style equipment since at least 2006, prompting questions on why the agency needs such weapons at all.

According to a job posting on USAJOBS.gov, the IRS is looking to fill 360 vacancies for new full-time criminal investigation special agents spread across all 50 U.S. states.

A job posting on the IRS Careers website for criminal investigation special agents says they will be authorized to carry a firearm and must be “willing and able to participate in arrests, execution of search warrants, and other dangerous assignments.”

“As a Special Agent you will combine your accounting skills with law enforcement skills to investigate financial crimes. Special Agents are duly sworn law enforcement officers trained to ‘follow the money,’” the posting reads.

What the IRS Commissioner Said

The questions surrounding the IRS were reignited after President Joe Biden and some Democrats announced a proposal to expand the IRS, which Republicans said would entail the hiring of 87,000 new employees over the next 10 years and increase funding by some $80 billion. The funding was secured under last year’s Inflation Reduction Act (IRA), which Biden signed into law.

During last month’s negotiations on the debt ceiling limit, House Republicans were able to cut about $1.4 billion from that new funding. They also were able to divert about $20 billion from the IRS over the next two years to other federal programs.

Earlier this year, IRS Commissioner Danny Werfel pushed back on claims that the tax agency is seeking to arm IRS auditors.

During an April 27 hearing in the House, Werfel was asked about armed agents by Rep. Richard Neal (D-Mass.). “With the additional money from the IRA, how many armed revenue agents will be hired?” Neal asked. “None, sir,” Werfel said in response.

“Does the IRS plan to hire 87,000 revenue agents to carry guns to audit families and small businesses?” Neal asked him. “We do not,” Werfel said.

The commissioner said that about 3 percent of IRS agents are armed, noting they belong to the Criminal Investigation Division. “They are investigating acute issues of fraud and tax evasion,” Werfel added. “Typically, they’re armed when they’re putting themselves in danger.”

But he said the IRS is planning to increase the number of officers in the criminal division by 1,200 over the next five years. However, Werfel also said that the IRS doesn’t plan on conducting a “new surge” of audits targeting “workers, retirees, and others,” adding, “We have plenty of other areas we need to focus on.”

The Epoch Times has contacted the IRS and the Treasury Department for comment.

Tom Ozimek contributed to this report.

By Jack Phillips Jack Phillips