Taking a page from the anti-gun rights playbook. About time!

While the new Constitutional Carry law in Texas has received a lot of attention from the national media this week (almost all of it negative, of course), another piece of legislation signed by Gov. Greg Abbott has quietly taken effect, and its implementation could have a big impact on the bottom line of some of the largest financial institutions in the country.

For several years now, we’ve seen big banks impose restrictions on their relationships with companies in the firearms industry; refusing to do business with firms that manufacture modern sporting rifles or “large capacity” magazines, for instance. Well, now these same banks are getting a taste of their own medicine, because unless they end their corporate gun control policies they won’t be allowed to underwrite municipal or state bonds.

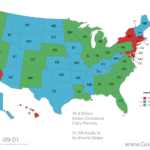

Some of the country’s largest banks, including Bank of America, Citibank, and JPMorgan Chase underwrite municipal and state debt in Texas, but also have tailored restrictions that appear to bar financing to certain parts of the gun industry, such as companies that make or sell bump stocks or sell to customers under 21.

By Cam Edwards